Calculation of Interest, Principal, and Payments

Examples of how to use the different calculations

Simple Interest

A company borrows $5,000 at 5 percent per annum simple interest. What payment must be made to retire the debt at the end of 8 years?

Compound Interest; Future Value of Single Payment

The sum of $3,000 was deposited in a fund that earned interest at 2 percent compounded quarterly. What was the principal in the fund at the end of 12 quarters?

Present Worth of Single Payment

A deposit was made in a fund that earns interest at 6 percent per annum. Five years later, the principal resulting from this deposit was $23,212. What sum was deposited?

Principal in Sinking Fund

A deposit of $200,000 was made each year for 8 years in a fund earning interest at 6 percent per annum. What was the principal in the fund immediately after the last deposit was made?

Determination of Sinking-Fund Deposit

A company has to repay $100,000 at the end of 6 years. To accumulate this sum, the company will make 6 equal annual deposits in a fund that earns interest at 3 percent, the first deposit being made 1 year after negotiation of the loan. What is the amount of the annual deposit required?

Present Worth of a Uniform Series

What is the present worth of 12 annual payments of $8,000 each?

Capital-Recovery Determination

A company decides to allot $32,000 by making a series of equal payments 4 times a year for 6 years. If the account earned interest at 3 percent compounded quarterly, what is the amount of the periodic payment?

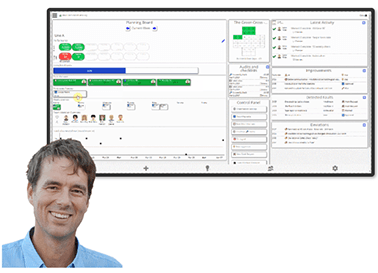

Advanced Visual Management Platform

- Unleash digital power on 5S, Improvements, Safety, Maintenance, and more

- Drive success with Lean and Operational Excellence practices

- Perfectly tailored for small to medium-sized manufacturing facilities

- Experience it first-hand with our free version - Embark on your journey today!